Purpose

The Proposal Report was created for conversations with both prospects and clients. As a LifeYield customer, part of your Advisor Alpha is the ability to show the portfolio impact of an asset location strategy. This report helps you structure the conversation so that all types of investors can understand the benefits of your approach.

When it comes to your current clients, this report lets you approach them with a structured narrative that shows them how you’ll improve their tax efficiency over time.

You can use this report in any situation where you’re proposing improvements to the Taxficient Score.

Talk Track

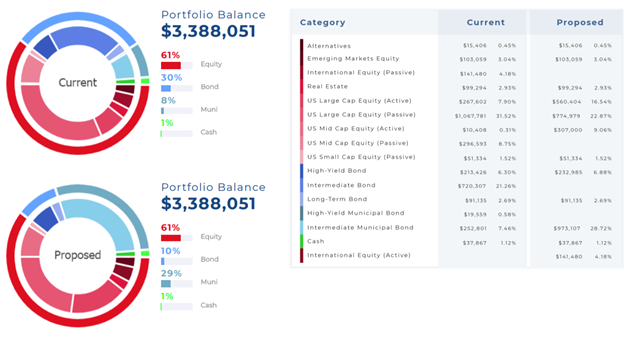

The first page of the proposal shows the client’s current portfolio asset allocation compared with the proposed portfolio asset allocation after implementing tax-smart asset location. You can use the table to highlight the changes across individual asset categories.

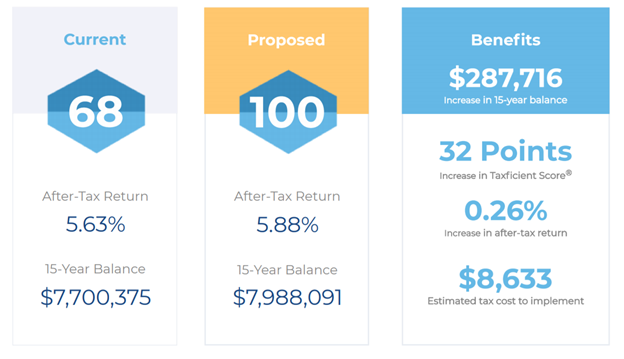

Page two is all about the Taxficient Score®. It measures the client’s current portfolio’s score on a scale of 0-100. In the next pane, it shows the proposed Taxficient Score after optimizing for asset location. In the summary pane to the right, it highlights all the benefits of making these portfolio improvements, including the dollar benefit, the increase in Taxficient Score, the percentage increase in after-tax return and the estimated tax cost to implement the changes.

Talking Point – There are no free lunches, well most the time. Take notice of the estimated tax cost compared to the benefit over time. Traditionally it has been difficult to convince a client to pay taxes now for an unknown benefit in the future. This report helps put it in context. If there isn’t an appetite to realize any gain, no problem! When you run the report, just set the gain limits to 0, we’ll show how far you can get before you need to realize gains.

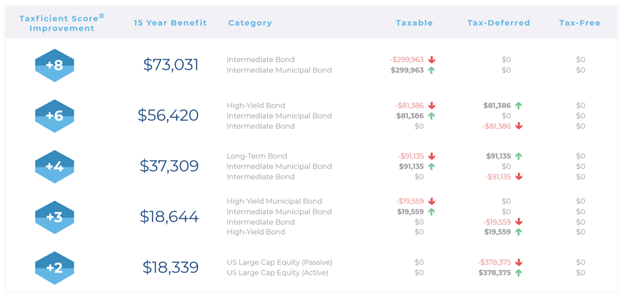

This page was designed to clearly articulate the value of each client’s unique asset location strategy. We have broken down some of the steps that can be taken to improve asset location for this specific client. The holdings are rolled up into categories, which works for most of our partners. But if you want to a detailed trade list, just run the detailed report. It’s all in there.

Page three and beyond includes supporting documentation for detailed conversations with investors who like to go into the weeds. This documentation includes a complete list of accounts and positions that make up the client’s full asset allocation. If an account is marked as held-away, it is likely limiting the amount of optimization that can be achieved.

The held-away report discusses this scenario in more detail.

Additional Details

The supporting documentation also includes the inputs that the LifeYield engine uses for optimization, including Tax Rates, Gain Limits and Capital Market Assumptions. These are placed at the end to keep the focus on the main objective of the report: The proposal.

NOTE: Make sure to update your disclosures in the Settings tab of LifeYield. They are automatically generated at the end of each report