Purpose

The Held-Away Accounts Report was created for conversations with current clients who have one or more accounts managed outside of your practice. In order to optimize asset location, all accounts in a household must be coordinated to work together as one portfolio. These reports highlight the potential after-tax benefit that can be achieved from consolidating all held away accounts. Leverage these conversations to increase wallet share and clearly articulate the tax benefits of asset consolidation.

You can use this report in situations where one or more of your client’s accounts are managed outside of your practice and show them the benefits of consolidating assets with you and optimizing all their accounts for tax efficiency.

Talk Track

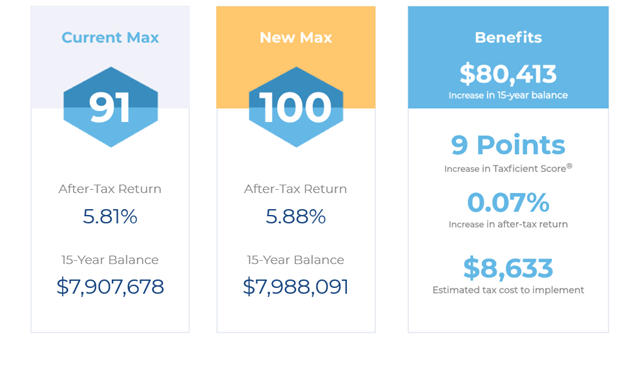

This report starts by illustrating the impact of coordinating all your accounts to work together as one portfolio. The second page compares the current maximum with the new maximum after optimizing for investment tax efficiency. In the example below, the maximum Taxficient Score® of 100 can only be reached by consolidating all accounts under the management of one advisor.

PRO TIP: Current Max is defined by optimizing all the accounts around the held-away account. New Max is defined by optimizing all the accounts including the held-away account. New Max might not always be 100 – if positions or accounts are locked, they will remain locked in this report.

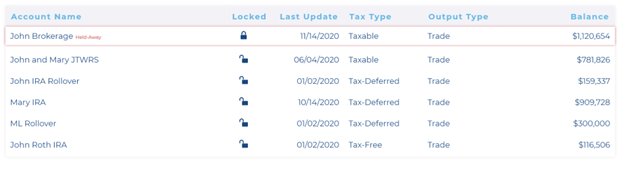

The next page of the report shows a list of all the accounts in your client’s portfolio. Those marked as held-away are limiting the amount of optimization that can be achieved.

If you are in a competitive situation, this report will drive home what account needs to move over to your firm and what that could mean to your clients.

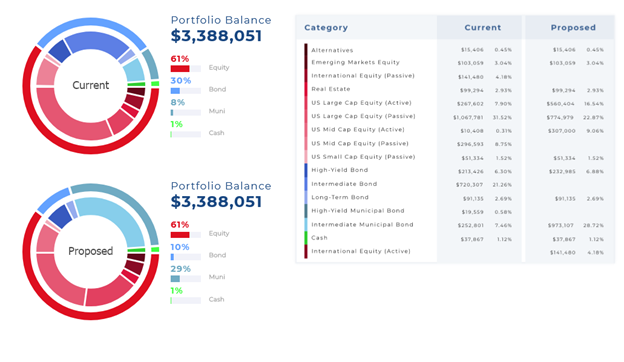

Page three compares your current and proposed portfolio with two levels of asset allocation. The detailed breakdown has the current balance of each asset category and compares it with the proposed balance after optimizing for asset location and consolidating all accounts.

Talking Point – LifeYield helps you clearly communicate the tax alpha generated from household managed portfolios. While some clients may have all their accounts managed by a single advisor, those who do not may be negatively impacted by investment tax drag. The held-away accounts report clearly illustrates and quantifies the impact to after-tax returns when one advisor (you) coordinates all accounts in a household portfolio.

Page five and beyond includes supporting documentation for detailed conversations with investors who like to go into the weeds. This documentation includes a complete list of accounts and positions that make up the client’s full asset allocation.

Additional Details

The supporting documentation also includes the inputs that the LifeYield engine uses for optimization, including Tax Rates, Gain Limits and Capital Market Assumptions. These are placed at the end to keep the focus on the main objective of the report: The proposal.

NOTE: Make sure to update your disclosures in the Settings tab of LifeYield. They are automatically generated at the end of each report.