Get started with LifeYield Portfolio+

LifeYield Portfolio+ analyzes all accounts in a household portfolio and measures the tax efficiency of all accounts, regardless of where they are held.

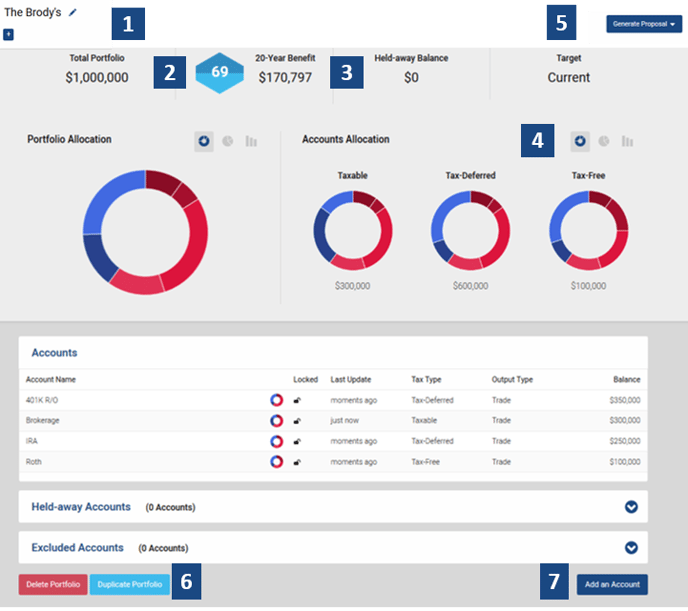

This image guides you through a quick overview of LifeYield Portfolio+, with each number corresponding to a number in the list that follows.

- Select the pencil icon next to the Portfolio name to edit the following settings:

- CMA set used

- Investment Timeframe

- Tax Rates

- Target Allocation

- Use of Equivalents

- LifeYield quantifies the tax-efficiency of a client portfolio with the Taxficient Score® ranging from 0-100. If the Brody’s achieve a score of 100, they can reap $170,797 in savings over the next 10 years.

- Dollar amount of assets held away.

- Various options to illustrate asset allocation in each account and total portfolio allocation.

- Distribution of assets across all accounts in the portfolio and asset allocation of each account along with each account balance.

- Options to generate Location Analysis and Withdrawal Analysis proposals.

- Delete Portfolio and Duplicate Portfolio buttons.

- Various options to add accounts.

Breaking Down the Location Analysis

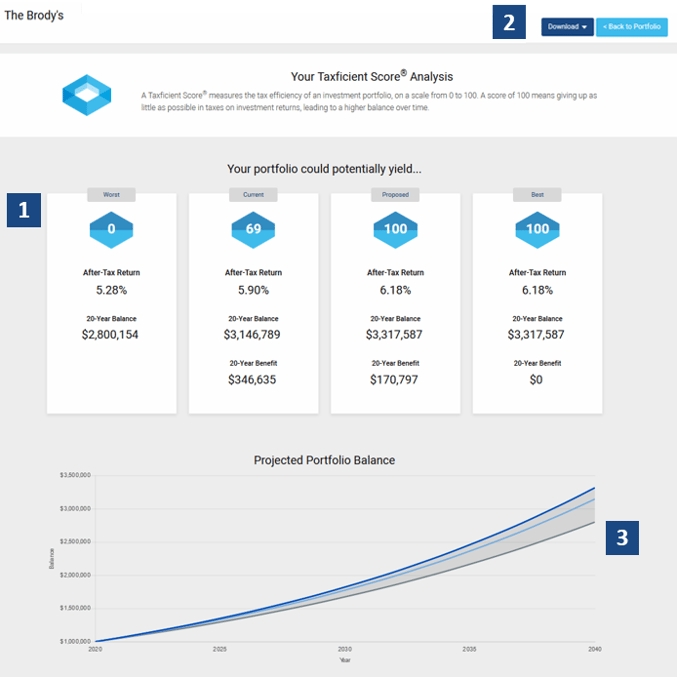

2. Options to download either a summary or detailed report.

3. Projected portfolio balance from best to worst-case scenarios.

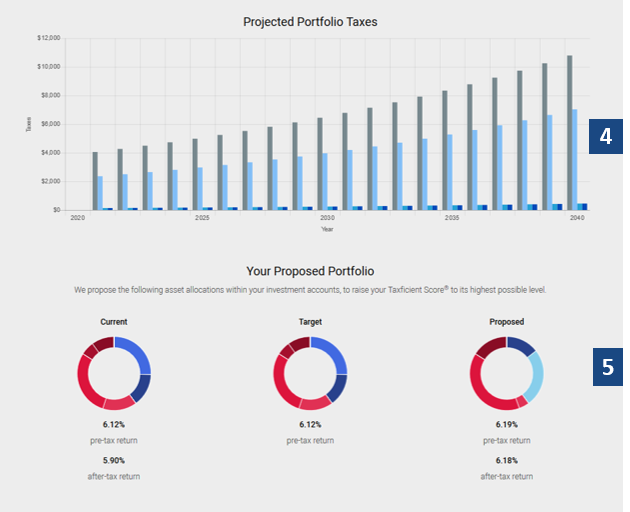

5. LifeYield proposes the following asset allocations within the client’s investment accounts to increase the Taxficient Score and maximize after-tax returns.