Get started with LifeYield Income+

LifeYield Income+ provides multi-account withdrawal strategies through using the cost-basis and purchase date of each position, going all the way down to tax lot when available.

LifeYield Income+ coordinates a tax-efficient withdrawal from all the accounts in the household with three goals in mind:

- Minimizing allocation drift

- Increasing your Taxficient Score®

- Realizing losses/minimizing gains

Executing the Withdrawal Analysis

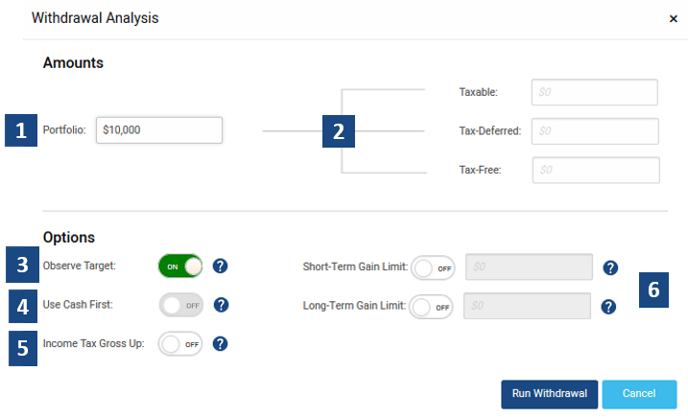

This image guides you through a quick overview of LifeYield Income+, with each number corresponding to a number in the list that follows.

- Enter the amount the client needs to withdraw here. This option will allow LifeYield to use all available assets with no registration constraints.

- Enter applicable amount to be taken from the corresponding registration type, EX: Required Minimum Distributions (RMD) would come out of Tax-Deferred.

- Choose this option to align the current allocation of the Portfolio to your Portfolio Target.

- Enable to prioritize cash sales first. This feature can only be used if the "Observe Target" option is turned off.

- Enable to increase withdrawal to meet the desired withdrawal amount, net of taxes.

- Maximum allowed short term/long term gains.

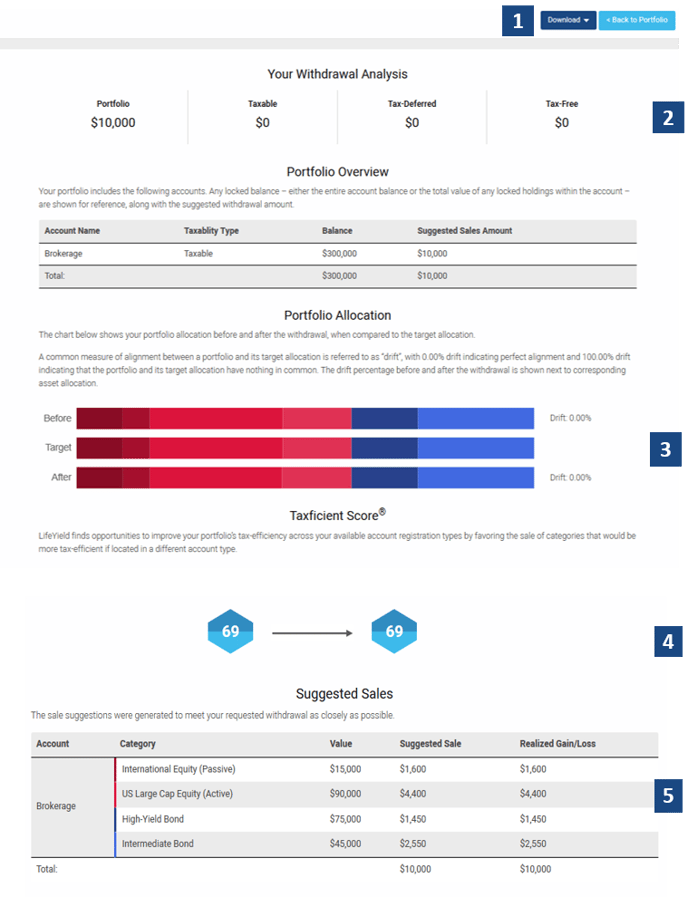

- By downloading the PDF report, show your client the:

- Full list of positions to sell

- Benefit of asset consolidation by demonstrating your added value

- Also available to download the sale list to excel, allowing you to configure our sale list for your trading platform easily

- Summary of withdrawal and account from which to sell, e.g., sell $10K from taxable account.

- These charts show the portfolio allocation before and after withdrawal, when compared to the target allocation. Drift is significantly minimized.

- Taxficient Score® is maintained ensuring optimal after-tax return.

- High level asset-class breakdown based on suggested sale(s).