The Power of Asset Location

ARE TAXES HOLDING YOUR INVESTMENTS BACK?

Every client wants to get the most out of their investments. They want the highest possible returns with the least amount of risk. Most investors own multiple accounts and products, purchased at different times, for different reasons, with little or no consideration of how those accounts may work together. The fact that a part of an investment’s growth is given up in taxes is often seen as unavoidable. However, there is a way to reduce the taxes paid on investments, capture more of the investment returns and without changing the investments themselves. Optimizing a portfolio’s asset location provides exactly that. This brief overview shows how asset location works and how a taxficient portfolio delivers the benefits of optimal asset location. We start by looking at two different ways of implementing the same mix of investments across two accounts: a taxable brokerage account and a tax-deferred IRA.

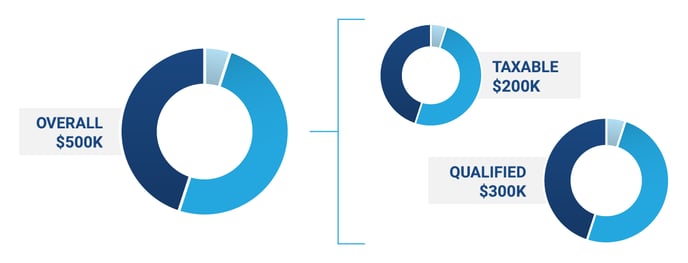

THE TRADITIONAL WAY: SAME ALLOCATION ACROSS DIFFERENT TYPES OF ACCOUNTS

After arriving at a mix of investments suitable for a client’s needs, with the traditional approach, all of the investor’s accounts look the same. This is a reliable way to ensure that the investment goal is met across multiple accounts. The charts below all look the same. However, because there is no consideration of after-tax returns, some assets are in accounts where their growth is subject to more taxes than necessary.

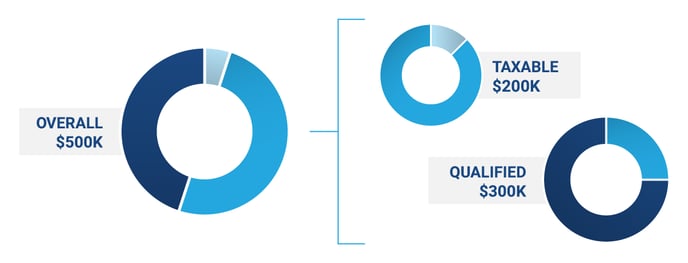

A TAXFICIENT PORTFOLIO: OPTIMIZING ASSET LOCATION

The goal of all investing should be to provide the highest after-tax returns across the entire portfolio. It begins by placing the assets where they will be most tax-efficient. Below is the same asset allocation applied across the same two accounts, but this time optimizing for asset location.

Although the overall investments across both accounts are the same as before, the components of that overall allocation have been distributed differently between the two accounts. The three charts no longer look identical.

By looking at the anticipated returns from each investment type, and then looking at the way they are taxed in one account type versus the other, we can locate investments so that they incur the least amount of taxes. This means that the client keeps more of the portfolio’s returns, without changing the overall investments.

TAXFICIENT PORTFOLIOS: FOCUSING ON AFTER-TAX RETURNS

The first example, typically followed by financial planning tools, only looks at pre-tax returns; the taxes due on those returns after setting up the chosen asset allocation across the client’s accounts are not a consideration. However, the taxficient portfolio in the second example focuses on maximizing after-tax returns, ensuring that the assets are optimally located and that the client keeps more of what they earned.

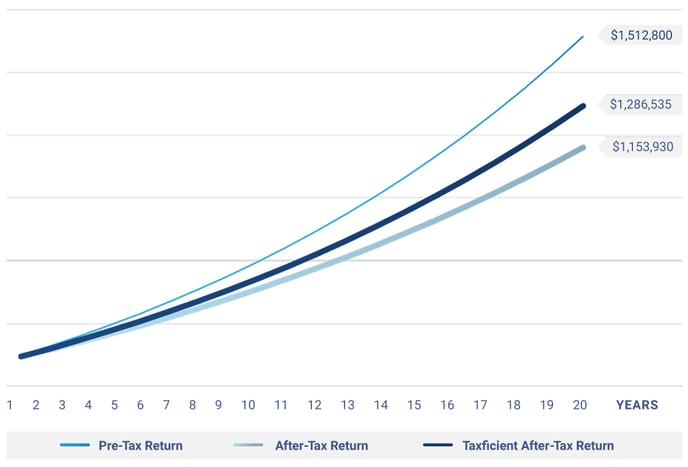

Let’s consider the same examples as before and see what this means. The overall asset allocation for the portfolio would have an annual pre-tax return of 6% if no taxes were due, but in practice taxes are inevitable. In the first example, the after-tax return would be 4.5%. However, in the second example, when optimizing asset location to implement the same overall asset allocation, the after-tax return increases to 5.1%.

That’s an improvement of 0.6% in annual after-tax investment returns. The Taxficient Score® shown above measures the portfolio’s tax efficiency from 0 to 100 and quantifies what that means to the investor. In this example, by optimizing asset location across multiple accounts, the portfolio’s balance may increase by up to $132,605 over a 20-year period.

SAME INVESTMENTS, SAME ACCOUNTS. KEEPING MORE OF WHAT THE MARKET RETURNS.

Taxficient portfolios optimize asset location across multiple accounts, providing considerable benefits by keeping investment taxes down and maximizing after-tax returns. This clearly distinguishes an advisor’s value and expertise.