Purpose

Annuities have evolved significantly in the last few years; carriers have created products that are more cost-effective and investment focused. The Annuity Analysis report is designed to highlight how an annuity fits into a household investment strategy. It illustrates:

- A process to determine how much of a household’s taxable assets should be transitioned.

- The value associated with transitioning assets to an annuity.

- The steps to execute on a new strategy.

Talk Track

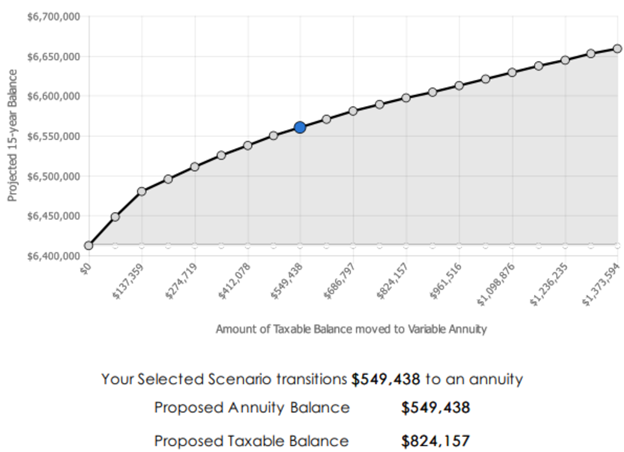

Page one highlights the amount of taxable assets being transitioned to an annuity. Ideally, you have collaborated with your client or prospect within the software to determine the appropriate amount. The graph highlights the progressive impact of transitioning assets. Also highlighted are the proposed annuity and taxable balances.

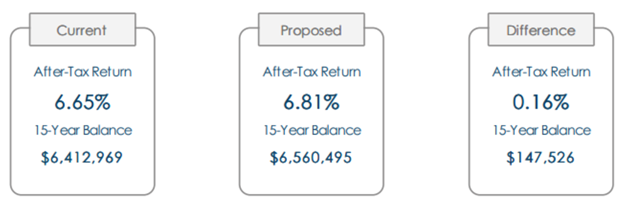

Page two is the “why?”. Here is where you provide your client or prospect with the motivation to implement. Adding Tax-Deferral to a household has a significant impact on outcomes. On this page, we clearly lay out the estimated improvement in the after-tax-return and the increase in portfolio value over the time frame that has been selected.

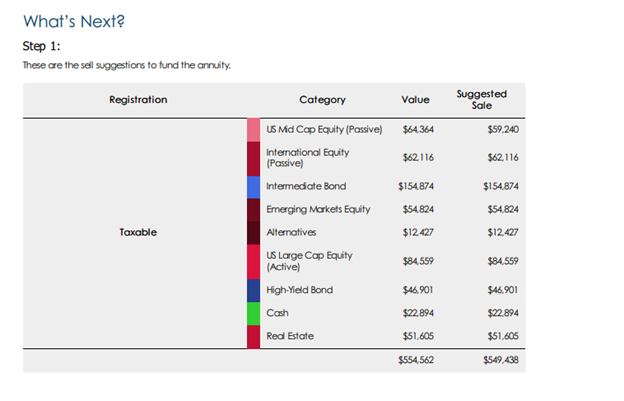

Page 3 and 4 show us “what’s next?”.

First, we look at how to get started. The software has looked across the household’s taxable assets and determined what to sell, raise cash, and fund the annuity. We are not just selling random securities, first, we look to optimize long term tax efficiency. Second, we will attempt to harvest as many losses as possible.

Talking Point: The strategy applied to funding an annuity can be confusing, and if done incorrectly can end up causing a massive tax bill for the client. LifeYields approach will optimize the process and layout a path to save on taxes now, and achieve more efficiency moving forward.

The strategy applied to funding an annuity can be confusing, and if done incorrectly can end up causing a massive tax bill for the client. LifeYields approach will optimize the process and layout a path to save on taxes now, and achieve more efficiency moving forward.

Next, we show the sales at the category level, more detail about the individual positions is provided later in the report. We show the category level upfront so you can walk your clients through it. For most cases, clients just want to know what time it is, and this report will help do just that.

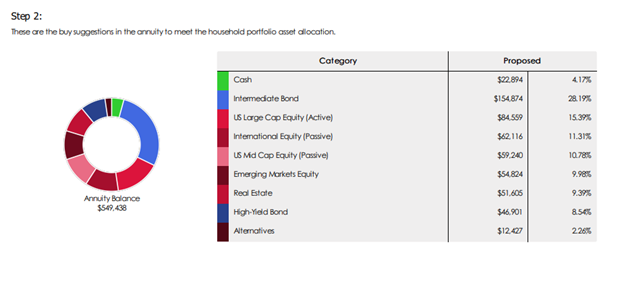

After you have gone through what to sell out of the taxable accounts, we will walk through what to buy in the Annuity to meet the household portfolio asset allocation. These recommendations are made at the category level, so you have options for investment selection.

The balance of the report provides the details - specific sales, including position and tax lot necessary to fund the annuity.

Additional Details

The supporting documentation also includes the inputs that the LifeYield engine uses for optimization, including Tax Rates, Gain Limits, and Capital Market Assumptions. These are placed at the end to keep the focus on the main objective of the report: Recommending an Annuity and illustrating the impact that could have on a client’s outcomes over time.

NOTE: Make sure to update your disclosures in the Settings tab of LifeYield. They are automatically generated at the end of each report